ETC College Rankings Index - User Guide

A College Rankings System for Developing a Practical College Plan

In 2013, we revolutionized college rankings by inventing an entirely new system whereby, colleges were ranked by the economic value they created for students. Our new methodology changed the trajectory of college planning for millions of families, and higher education. People began focusing on Return On Investment, occupational outcomes, student debt – and other factors that we characterized as ‘college financial planning’. Each year thereafter, we produced an updated College Rankings Index that focused people on looking at the economic value created by colleges, rather than prestigious labels. In recent years, college costs and dramatic changes in the labor market have necessitated another major update to our system of ranking colleges.

For 2022, the College Rankings Index has been completely overhauled. The most significant changes include:

- Personalization of list – the 2022 Index enables you to enter criteria regarding your academic interests and competency, which generates a list of colleges that will be a true personalized fit.

- Focus on academic major – the changes in the labor market are a mandate that students focus on the skills of the future. Every parent is deeply concerned about ensuring their child has the skills needed to compete in the new economy.

- Emphasis on reducing your tuition – college costs have been rising faster than inflation for 30 years. The 2022 Index will help you identify the colleges that will offer you the best value. Furthermore, at most colleges, tuition is negotiable. The data points we provide to you are for the purpose of helping you to negotiate the largest discount possible.

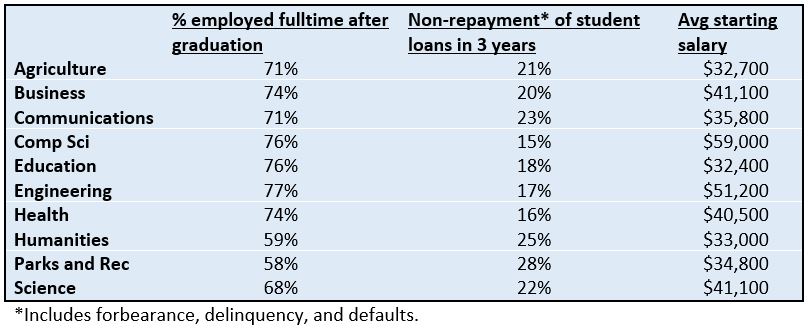

The Importance of Academic Major

Choosing an academic major with high economic value, and studying that major at a college that provides good educational value is a winning strategy.

How to interpret the data points provided by the ETC College Rankings Index

Free Data Points

- Instate tuition – Full price, or ‘sticker price’. The tuition before any discounts, grants, scholarships or other reductions are applied.

- Net instate tuition - The tuition after all discounts, grants, scholarships or other reductions are applied.

- Trend in net instate tuition – This is the % change in the net tuition charged by the college from 2016 to 2019.

- Trend in enrollment - This is the % change in new enrollments at the college from 2016 to 2019.

- Enrollment – Total number of students enrolled.

- Percent admitted – This figure represents the selectivity of the college.

Premium Data Points

- Average Institutional Grant – This is a modeled estimate representing the average institutional grant given in 2020.

- % of students receiving Institutional Grant – This shows the % of students who received an institutional grant in 2020.

- Estimated net tuition for 2020 – The estimated net tuition after all discounts, grants, scholarships or other reductions have been applied.

- Estimated enrollment for 2020 – The estimated total number of students enrolled.

- Average salary for 2020 graduates – The average starting salary of graduates working full time.

How to utilize the data provided

As you are reading this User Guide, it should be clear that your choice of academic major is critically important. Where you study is also important and, in many instances, the wisest choice is the lowest cost college. For example, if you’re planning to become a nurse and work in a hospital setting, the nurses in a hospital are paid on a wage scale. Nurses with the same level of experience are paid the same wage, regardless of where they attended college. A nurse who attended a $60,000 per year private college earns the same as the nurse who earned her degree at the $6,000 annual tuition state college.

Things aren’t always so cut and dried however. If you’re planning to study business, take note of the average starting salaries at the colleges you’re contemplating. You may find some fairly significant differences between the colleges. Certain colleges may have a better entrepreneurial network, while others might have stronger alumni relationship with large employers. You’ll need to do a cost/benefit analysis to make the final determination. Are you going to spend $10,000 per year more in tuition to earn $1000 higher salary?

College tuitions are negotiable

As we have stated throughout this program, college tuitions are negotiable. As you have seen in your list of colleges, each one has an ‘In state tuition’ which is full price. Then there is the ‘Net in state tuition’ which is the average price paid after all discounts (grants, scholarships, and other forms of aid) are deducted from the full price. Keep in mind that any grants or aid that comes from the federal or state government will be available to you at each college to which you are applying. What is unique among the colleges is what is referred to as ‘institutional aid’. Each college has its own institutional aid budget, and full discretion regarding who to offer that aid to, and how much aid they will offer.

It is very beneficial for you to know in advance, with which colleges you will have some negotiating leverage, and those where you won’t. Within any given college, there are two primary criteria that influence the college’s decisioning processes regarding who to give aid to, and how much aid to give:

- Your SAT/ACT in relation to the range of a given college. Assuming you’re within the college’s range, the higher your score, the higher the probability that they will accept you. And, when you have a higher probability of being accepted by a given college, the more likely they are to increase the amount of institutional aid they will offer you.

- Family finances are also a strong consideration by colleges. Colleges are run like a business, and accordingly, they need revenue. They prefer people who can pay more tuitions. Those who can pay more, generally do pay more.

To understand more regarding admissions practices and the inter-relationship between test scores and family finances, review the User Guide for our Admissions Probability Program. This provides very deep insights into the methodologies employed by college admissions offices in determining who to admit, to whom they will offer institutional aid, and how much institutional aid will be offered.

Strategic planning and fiscal responsibility for college planning, and your career

The new College Rankings Index is a crucial starting point for your college planning. If you do not even use the program to develop a college list, that is fine. The key takeaways are that you recognize the importance of choosing a college major that leads to a real job, and that you study that major at an affordable college. Select the right major and keep your costs low.

We have 2 other programs that we strongly recommend you incorporate into your college planning process:

College Admissions Probability – this provides you with the probability of being accepted to the colleges you are contemplating, along with your Expected Family Contribution (tuition). This program is a logical next step once you’ve developed a preliminary list from our College Rankings Index.

College Business Plan – build a true budget that is based on your expected college plan. This program will create a real college financial plan that includes your expenditures, your post graduation earnings, and it presents the information to you in a simple format that enables you to revise scenarios to develop a plan that is economically viable.

Lastly, most of our programs are free or operate on a ‘freemium’ pricing model. Premium data run anywhere from $5 to $25 per analysis, depending upon the program. However, subscriptions are available and start at $25 per month for unlimited access to all college planning programs. So you can save money on the data and information that will help you formulate a winning college plan, and we’re a non-profit.

Educate To Career (ETC) is a 501(c)(3) nonprofit. Our mission is focused on helping our youth (particularly the disadvantaged) to secure their best futures via college and career. We do this by providing data and programs which enable families to develop career tracking college plans, with a keen eye on fiscal responsibility.